Many sports clubs believe solely in mass communication, where they present the same message to all their supporters across all social media platforms and their own channels. Besides nicely presentable reach and engagement numbers, the effect of mass communication on clear business benefits is questionable. Are supporters becoming more loyal or are they going to visit the stadium more frequently after receiving the same message? Or are they getting bored by this? What about 1:1 supporter interaction through personalized communication and marketing? Is that the answer to sold out stadiums and increased loyalty?

In the sports corporate world, everyone is talking about a 360° fan view and data-driven fan engagement. However, as with so many other topics, such as NFTs and the Metaverse, it is difficult to differentiate the hype from the true business impact. Join in on my research journey as I seek to uncover how one major European football team turns database marketing and 1:1 supporter interaction through personalized communication into a tool for selling out their stadium and increasing measurable loyalty among their supporters.

Introduction

In my experience, too litte attention has been paid so far to the true business effects of 1:1 marketing in sports. Furthermore, there has been insufficient focus on understanding the underlying layers of demographics, supporter lifetime value, and purchase behaviour of supporter groups with and without marketing consent.

Peter Kekesi | Product Manager

Have you ever wondered:

Whether the supporters in your stadium are the same people who receive your newsletters?

How your direct marketing campaigns impact your ticket sales?

If your most valuable supporters provide marketing consent after being already loyal, or if your marketing efforts convert them to higher levels of loyalty?

If there is a difference in the frequency, recency and total spend between supporters who have given consent for marketing and those who have not?

These are the questions I, at least, was wondering about when trying to create supporter engagement, database growth and ticketing strategies in partnership with several European sports organizations. I learnt, however, that in many cases sports organizations simply did not have enough data to give a direct and concrete answer. Without the data, many false and risky assumptions were made, leading to inefficient communication channel selection and marketing spend. To give a few simple examples, the sports organizations did not know whether selling season tickets was best done through newsletters, organic and paid social media ads, direct mail to the mailbox of supporters, billboards in the club’s district, or what mixture of the above contributed in what way.

Finding the right club to conduct my research with

To overcome this challenge, I started looking for a club that could answer the above questions. My search criteria was the club:

- Needed to be a top club in its local league and have a significant (over 100k) database

- Should have been working with database marketing for several years, even before GDPR

- Should be competing not only domestically but internationally on a regular basis

- Had data about supporters’ age, gender, marketing consent, buying recency, frequency, monetary spend, stadium visiting behavior and marketing consent

To my luck, not long after my search began, I found a club fitting all of the above criteria, with a supporter database that had been built over a decade. The database included different levels of marketing consent and all supporters in their stadium had been identified. I mainly focused on ticketing sales on the first leg of my research. Merchandise and other business pillars of the club will be part of a later research.

Is marketing consent relevant for selling out the stadium?

Although everyone with experience working in the sports tech sector seems convinced about the relevance and impact of marketing consent, I aimed to find concrete and tangible evidence at the subject club of this research. I used the Data Talks sports Customer Data Platform to collect, segment and analyze their database, and found insights that were not just new to me, but an eye-opener for the club itself.

What do the numbers say?

Club demographics

According to the club’s previous in-house market research, the club has a few million sympathizers in total, i.e. people who when asked, name a certain club as the one they support but are not necessarily actively following the club. These sympathizers are mainly in the club’s homeland with a growing base in other European countries as well. Their supporter database consists of approximately 300,000 identifiable profiles of which 28% have over the years given full marketing consent. Moreover, 72% had ended up in their database after buying tickets, visiting the stadium or giving partial marketing consent through some of the club’s activations. We can look at these numbers as the glass half full or half empty – 28% of fully consented supporters can be a debatable achievement over years.

How the supporter database was collected

The team collected the supporter database through multiple channels with both continuous and ad-hoc efforts:

- Ticketing system: the ticketing system generated 83% of the total database over the years

- Merchandising platform: this generated much smaller volumes of new database signups. The pattern here was that supporters would first buy a ticket then later buy some merchandise

- OTT-platform: a web-based solution to watch the pre-season games live

- Website marketing tools: from signup forms and popups

- Gamification: such as match score predictor, man of the match poll

- Mobile application: registered users of the club’s mobile application who get access to exclusive content after logging in

Investigating the data

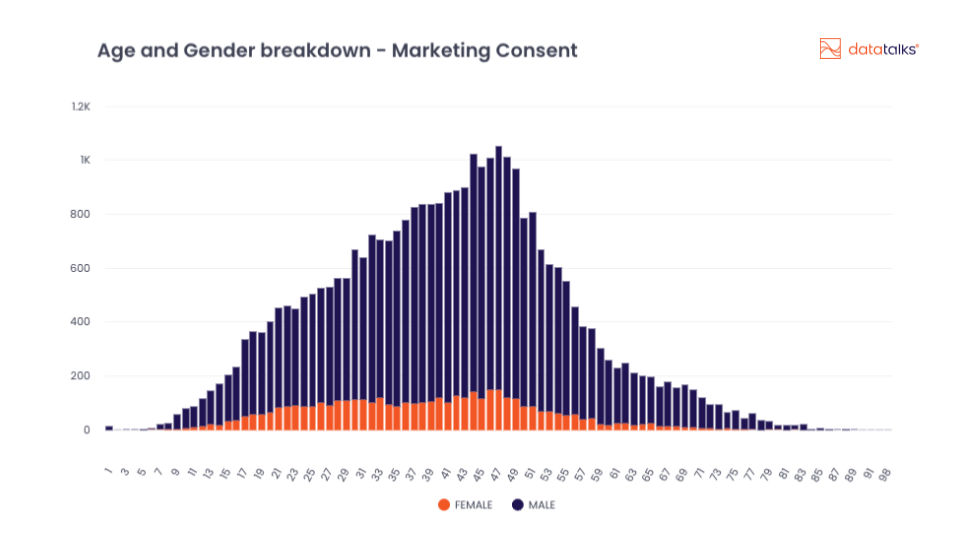

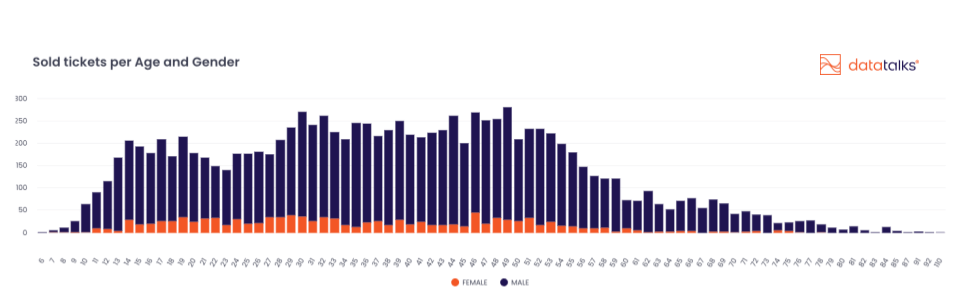

Looking further into the database, we could see an interesting distribution of supporters based on age and gender. It is quite usual in European clubs’ databases to see approximately 70:30% distribution between male and female supporters, with a trend like closing scissors. This is also what we see in this club’s case on the chart below. However, when looking at the age spikes in the club’s data, we can see something unusual, several spikes and dips that cannot be explained just by applying theories.

I needed to investigate further and understand the context. Why do we see three very distinct peaks at the ages of 15, 30-35 and 45-50, and why is there a drop in between those and especially after the age of 50?

Factors that could have influenced this pattern

Many factors can influence this starting from the club’s on-pitch success, the popularity of the sport and the country’s economic and political situation, all in light of what the typical age is when a supporter becomes a supporter. Do we see the peak at 15 because that is when parents take their teenagers to the stadium for the first time? Or is it when a group of high school friends decide to go to the stadium for the first time together? Was the peak when friends from university or recent graduates with their first salaries decide to buy their first season tickets? There are surely many possible answers to this question, which in itself deserves further research.

One thing for sure is that we got a completely different picture when we looked at the same graph, just filtered by marketing consent.

We see a completely different picture, a more even distribution among the age groups with two very clear differences from the first graph:

- The peaks at 15 and 30-35 ages are gone, and instead we see an older marketing consented supporter population with the highest peak around 50

- The proportion between male and female supporters is different, with many more males opting in for marketing communication than their female counterparts

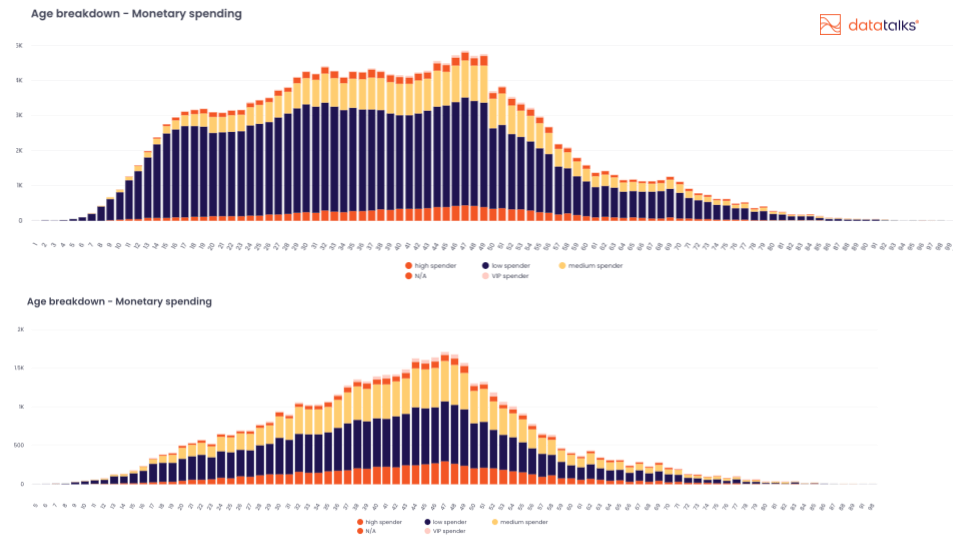

Spending levels of supporters

In this research we also categorised the supporters based on their spending levels, so each supporter falls into the groups of low spenders, medium spenders, high spenders and VIP spenders. Apart from the age differences, comparing the total database and the marketing consented database reveals one significant difference in spending habits of the supporters: it is clear from the graphs below that there are many more low spenders (one-time visitors) in the total database than in the consented group. Those with opt-in status, are much more likely to be at least medium, but many times also high-spenders.

This finding is not necessarily surprising but confirms that it is not a random choice to be on the marketing list of the club, it rather shows a higher level of engagement and a supporter reaching a further, more loyal stage in their supporter journey.

Is there a similar difference looking purely at ticket sales historical data?

For this part of the research, I received a decade’s worth of ticket sales data, including every supporter and ticket – approximately 1 million tickets sold during these years.

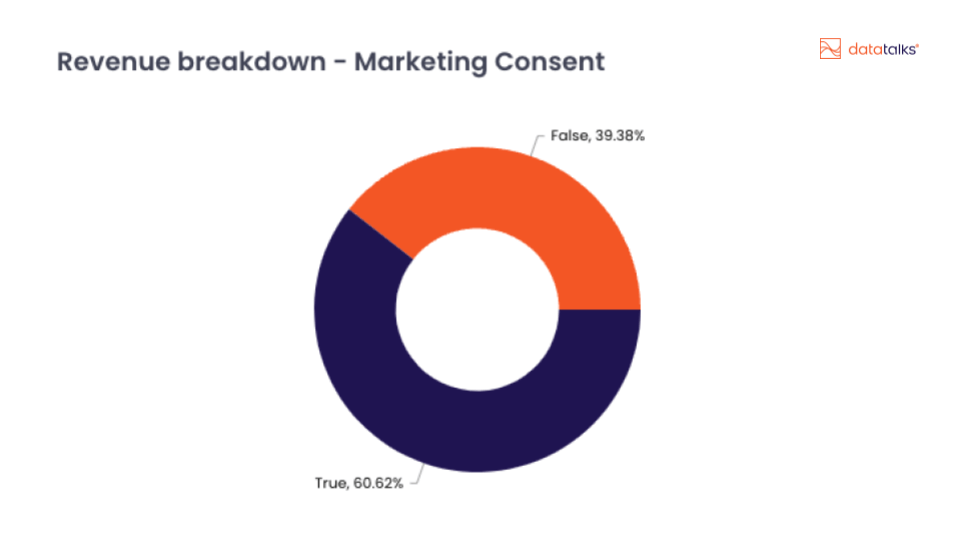

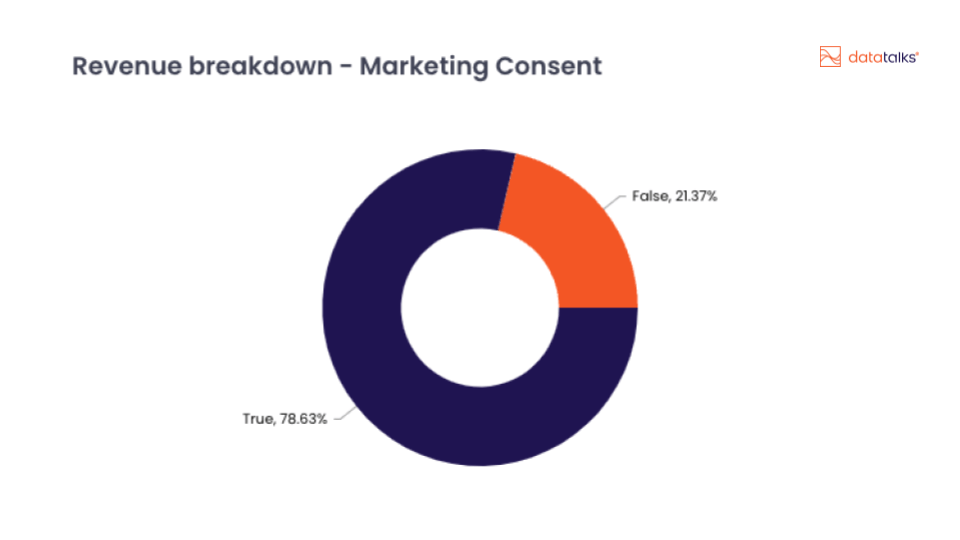

Putting the entire data set under the microscope, we could see that 61% of all ticket revenue has come from people with marketing consent. If we look back on the very first numbers of this article, we saw that only 28% of the database had given consent, which means that 28% of the supporter base is responsible for 61% of all ticket revenue. Not exactly the 80-20% Pareto principle yet, but very impressive, consent can be translated to loyalty and higher spending classes. Maybe, having the 28% consent of the database is not bad at all?

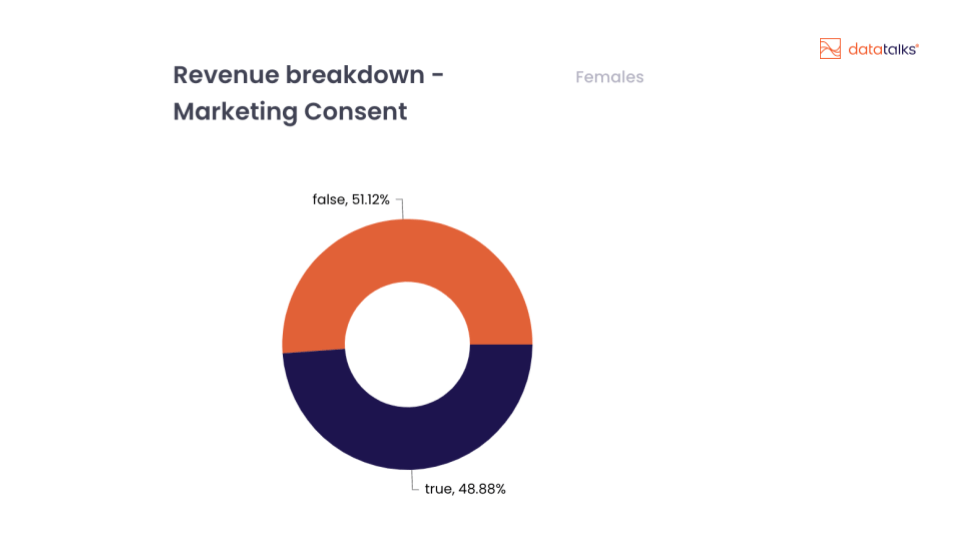

The male to female spending difference

We can notice in the chart below a significant difference in spending patterns for the male and female supporters. While for males, an even higher proportion of the revenue comes from consented supporters (64%), for females a much bigger portion of the revenue stems from supporters who are not benefitting (yet) from 1:1 communication. Clearly, there is room for development here and a more in-depth research is required to understand the motives and obstacles for female supporters.

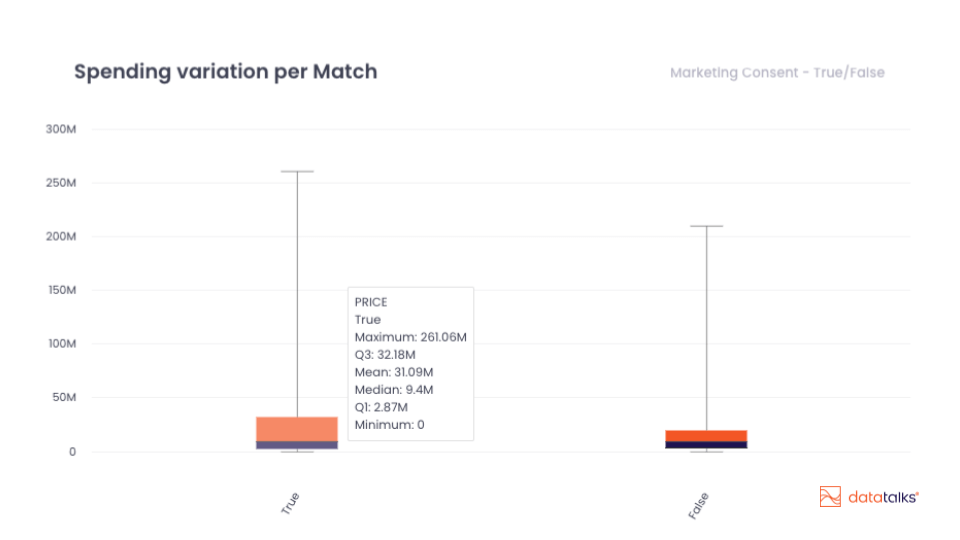

This difference is even more visible when understanding the spending variation between the two groups per match. It is clear that consented supporters spend on average 51% more per match compared to the less loyal, supporter groups who have not given their consent.

Is there an even more positive development over time?

When we look only at the season tickets sold over the last 5 seasons (pandemic included), we see an even more stunning number: 76% of total season ticket revenue comes from supporters with marketing consent. Finally, if we only consider the season ticket sales for season 2023/24, we reach in fact the Pareto principle: 79% of all season ticket revenue comes from the 28% supporters who have given marketing consent, the truly regular and most loyal supporters.

Opportunity with International matches

We can spot a great opportunity for the club when we add one last variable to our analysis, the international matches of recent years. The breakdown for international games is only 65% to marketing consented supporters. This means that the highly prestigious international games attract often completely new audiences, people who have never attended a game before, and people who are not yet a dedicated fan. There is a golden opportunity here for the club. The opportunity lies in capturing fans interest in these games and offering targeted campaigns only to them. This, not only to get them into the stadium but to also encourage them to stay with the club afterwards. This is significant because it means thousands of new supporters with wallets that can afford attending high-priced international games.

These new supporters not only come with strong purchasing power, but they also benefit the population pyramid of the clubs. The proven benefit of international games against bigger teams is that they attract younger groups of 10-20 and 25-35. This simply means that the previously lacking younger audiences will be attracted by fame and glory, to eventually become first time supporters.

OTT – a game-changer?

In the past few years, one club after another has announced their own initiatives within OTT. Initiatives like introducing their own video platform for streaming league or training matches, interviews, press conferences and other behind-the-scenes footage. These platforms are indeed popular nowadays. And this is only set to keep rising. OTT platforms are always advertised as an opportunity to attract new and younger fans with the added benefit of bringing unparalleled and self-controlled broadcasting revenue streams for the club.

The European club that is the subject of this research also introduced its own initiative – they stream their pre-season games. Initially, the “price” of streaming access was signing up to the database and giving marketing consent. They later turned this into a symbolic payment of 0,5 EUR for charity purposes. When the matches were only tied to signing up to the database, there were thousands of viewers for every training match. However, introducing a payment wall resulted in stunning figures. Approximately 25% of the previous viewership number was ready to pay for the streaming, although:

- 96% of fans were already on the marketing list

- 97% of the audience was male

- The most dominant age group was 50-55

In this one and non-representative example, we could thus conclude that some experimential OTT initiative in itself is neither going to attract new fans, nor attract a younger fan base, but rather this further strengthens the loyalty of existing fans.

Does 1:1 personalized communication actually matter for ticket sales?

To conclude my analysis, it is time to look at the initial questions:

- Whether the supporters in your stadium are the same people who are receiving your newsletters?

- What impact your direct marketing campaigns make on ticket sales?

- If your most valuable supporters are giving marketing consent after they already are loyal, or if it is your marketing efforts that convert them to higher loyalty?

- If there is a difference in the frequency, recency and total spending of your consented and non-consented supporters?

From analyzing the supporter database of the European club that is the subject of our research and their ticket sales history over the past decade, we can conclude:

- It is very clear that most supporters who visit the stadium are in fact also in the supporter database with marketing consent, and also that the most important channel of collecting more people into the database is the ticketing system

- There is a clear trend over the years that shows that a growing portion of ticket sales revenue comes from supporters who have given marketing consent, hence focusing on building the supporter database and sending 1:1 personalized campaigns is crucial to having a full stadium

- We can see clearly that supporters opted in for marketing communication visit the stadium more often and fall into higher spending classes. Very few supporters who have come as far as signing up for direct marketing will be seldom-visitors of the stadium

- The data set makes it obvious that older generations (who have likely been fans for a longer time) are more likely to give consent, and to attract the attention of younger audiences the clubs need to be creative and more versatile in their channel selection and marketing mix

- Thinking in terms of funnels always helps: without overcomplicating it, consider three key steps and how you can move supporters from the top of the funnel towards the bottom of the funnel:

- Top funnel: supporters who follow your club on tv & social media but have never bought a ticket or merchandise

- Middle funnel: supporters who made at least one purchase in their lifetime, thus identified themselves

- Bottom funnel: core supporters who have given marketing consent and are always with the club through thick and thin

What opportunities are there for your club?

Growing your supporter base is a necessity

Growing your supporter database is an inevitability in 2023, otherwise you will end up relying too much on your gut feeling when deciding on your next season ticket, jersey launch or sponsorship activation campaigns. It is never too late to start, and at first you do not need to do anything more than collecting the data that is already available to you from your newsletter, ticketing and merchandise system. This will give plenty of information to start off with.

Analyse your database for key insights

You can continue deepening your knowledge of the supporters once you have established the foundations. Try learning more about their demographics and intrinsic and extrinsic motivations. Answering the question: why is a supporter a supporter of just your club and what are the decisive moments before they become an actual supporter of your clubs. Use surveys, gamification, mobile and web behavior tracking to collect 0 and 1st party data from your fans.

A holistic view is the best kind of view

Aim to achieve a holistic view of your database based on your supporters' age, gender breakdown, location (distance from the stadium) to see where you are strong and where you are lacking, especially when considering marketing consent as well. There are three things you need for this: a strategic decision at your organization, a platform to handle all the transactional and behavioral data, such as the Data Talks Sports CDP, and the campaigns that attract fans and incentivise providing their data to your club.

Attracting younger supporters is crucial

In general, to attract younger and new supporters, you need to be creative: create games and sweepstakes that give a clear reason why they should be in your database, and find them on the channels they use. Don’t expect them to be just on the channels you are familiar and comfortable with. Use Tiktok for example and involve your players in digital meet & greets. Make sure your fans feel to be closer to your club and your players.

A continuous supporter experience is key

Always aim to combine the online with the offline and create a continuous supporter experience: if you know who the supporters are, who come to your games but not yet given consent, why don’t you surprise them in the arena, at their seats. You can involve sponsors for matchday activations and giveaways, provide in-stadium food ordering through a mobile application, give vouchers for people using the stadium wifi and simply create a theme for each game - such as sustainability - that attracts new and newer audiences.

Examples and opportunities are plenty, and one thing to be sure about, supporter data and 1:1 marketing is your friend to achieve a truly exceptional supporter experience and to get your stadium full on not just the most attractive, but also the lower prestige domestic games.